Supporting NZ businesses with Prospa

We're proud to work with Prospa, a company providing lending to local businesses across NZ.

With over 10 years in the industry, Prospa provide businesses with financial management that's simple, stress free and seamless. They're proud to support local businesses across NZ, providing a great depth of knowledge and understanding of small businesses needs.

Listening, learning, and evolving alongside their customers, Prospa has made a positive impact in the market, continuing to be pioneers in providing streamlined processes and products for small businesses.

All About Prospa...

Prospa offers a range of business lending options to best suit the customer. They have an application process that is simple and straightforward with clear guidelines of the information needed.

Here are some reasons why small businesses are choosing Prospa:

- Speed - Applications in under 10 minutes, quick decisions and funding possible in hours.

- Flexibility - Make business happen with their range of lending products designed for what your business needs.

- Support - Their dedicated Business Lending Specialists get to know you, and your business.

- Confidence - Join thousands of small businesses who thrive with the support of Prospa.

Loan Options...

With their strong ideals and great expertise, Prospa have formulated three loan types to best suit businesses in New Zealand:

Prospa Small Business Loan

• Same-day access to $5K - $150K to keep your business moving.

• Terms up to 3 years

• Easy application process with fast approvals and funding possible in hours

• Make unlimited extra repayments to save on your interest

• No asset security required upfront to access Prospa funding up to $150K

Prospa Business Loan Plus

• Access $150K - $500K to invest in a plan to take your business further.

• Terms up to 5 years for lower weekly repayments.

• Pre-approval available for loans above $250K, no credit check required.*

• Upfront asset security required; charge over the applying business entity(ies).

• Property ownership required, have a minimum 3 years trading history and $1M annual turnover to apply.

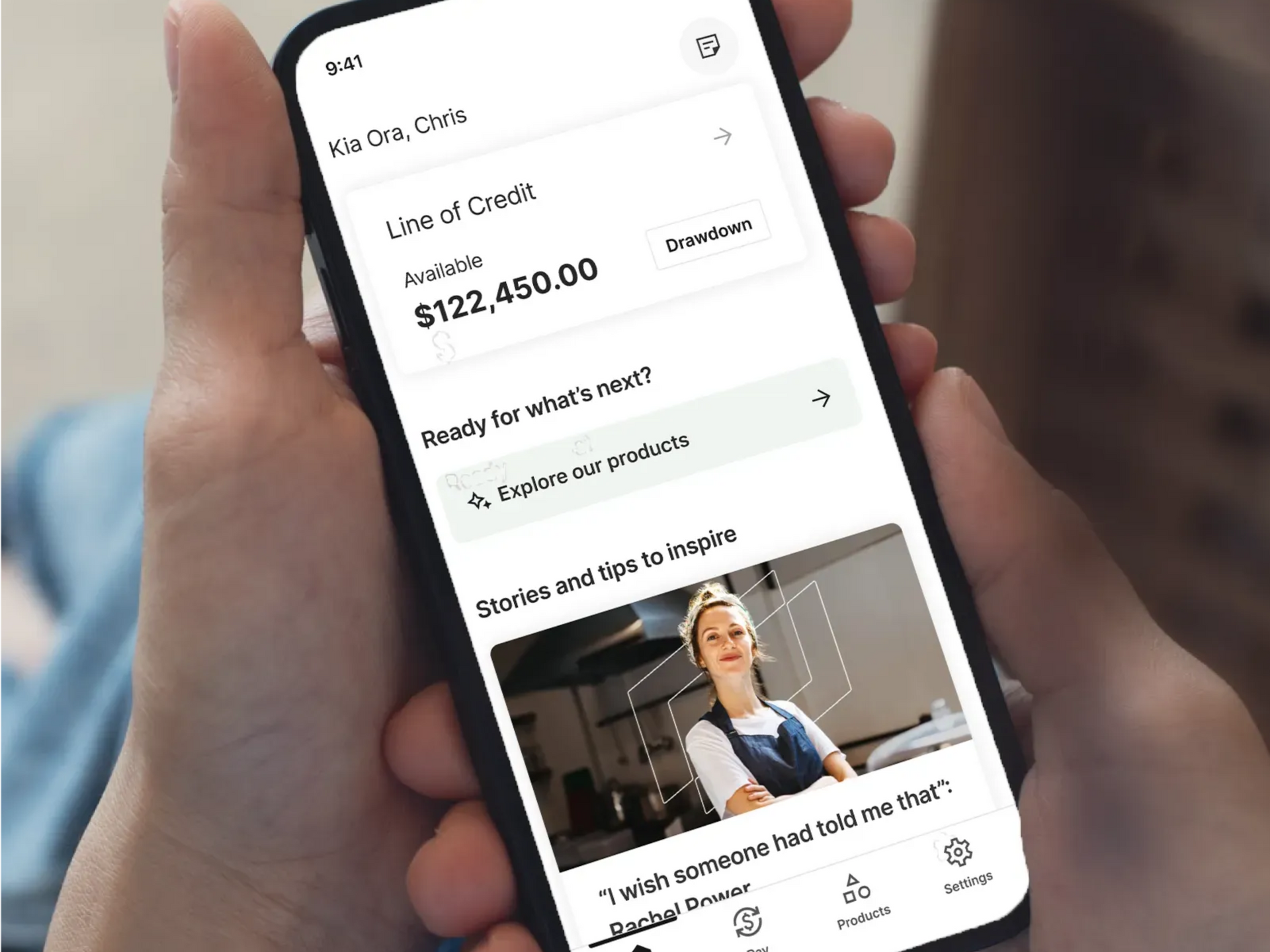

Prospa Business Line of Credit

• Ongoing access up to $500K to simplify your cash flow.

• Unlimited access for 2 years, with option to renew.

• Fast approvals and funding possible in hours.

• Only pay interest on the funds you use.

• Access funds anytime, wherever you are with the Prospa App or Prospa Online.

*Lending criteria and terms & conditions apply.*

If this has sparked your interest in applying for a business loan through Prospa, please feel free to get in touch to discuss your needs.

Looking forward to hearing from you,

Fiona & Amy