Understanding Kāinga Ora's First Home Partner Scheme

Kāinga Ora has recently made changes to their First Home Partner Scheme, making it easier to meet the criteria.

Effective from August 14th 2023, Kāinga Ora have extended their criteria around the scheme, making more first home buyers eligible. Along with these changes, I thought it would be a great opportunity to provide an explanation of how the First Home Partner Scheme works.

First Home Partner Scheme - How it works...

The scheme acts as a shared ownership, meaning that you are the majority homeowner, but Kāinga Ora (being a third party) shares this ownership. When applying for a home loan, as long as you complete the necessary steps and meet the criteria, Kāinga Ora will contribute an agreed amount towards purchasing the home in return for an equivalent share of ownership.

Example:

You have a 5% deposit of the homes purchase price and a bank is willing to lend you 80%. Kāinga Ora then contributes the remaining 15% towards the purchase in return for an equivalent 15% share in ownership of the home.

Latest Changes (Effective August 14th 2023):

- All eligible applicants can purchase existing homes, in addition to new builds, through the scheme. This is intended to provide buyers with a greater choice of homes.

- The household income cap has increased from $130,000 to $150,000.

- The income cap criteria for intergenerational whanāu has broadened to include larger whānau, allowing eligible whānau of at least six people who normally live together to purchase a home through First Home Partner.

Key Aspects to Remember:

- First Home Partner can only be used to purchase brand new homes or homes off the plans.

- You and Kāinga Ora will sign a shared ownership agreement in order to purchase the home together.

- Kāinga Ora will be a co-owner on the title of the home with you as long as Kāinga Ora owns a share of the home.

- You will commit to living in the home as your primary place of residence for at least 3 years from the settlement date.

- You will meet annually with Kāinga Ora to discuss your progress towards becoming a full homeowner.

- You will need to plan to purchase the share of the home owned by Kāinga Ora within the first 15 years of ownership.

- You will need to seek prior approval from Kāinga Ora before making improvements or renovations to your home, selling your home or selling your share in the home to another party.

Eligibility Criteria...

To be eligible for First Home Partner, you need to meet the following eligibility criteria.

- Be over 18 years old.

- Be a New Zealand citizen, permanent resident or resident visa holder who is ordinarily resident in New Zealand or

- Be applying with someone who meets the citizenship or residency requirements, and you are married to or are in a civil union or de facto relationship with that person.

- Be a first home buyer or previous homeowner in a similar financial position to a first home buyer.

- Have a total household income of no more than $130,000 (before tax) from the last 12 months.

- Have not previously received shared home ownership support from Kāinga Ora.

You will also need to:

- Be in a financial position to contribute a minimum deposit of 5% towards the home purchase (inclusive of all savings, grants, first-home withdrawals and gifts).

- Meet the lending requirements of a participating bank for a home loan.

- Be buying the home for you to live in as your primary place of residence.

- Commit to living in the home for at least 3 years from the settlement date.

If your personal circumstances change and require you to move or sell your home within this minimum occupancy period, you will need to discuss this with Kāinga Ora.

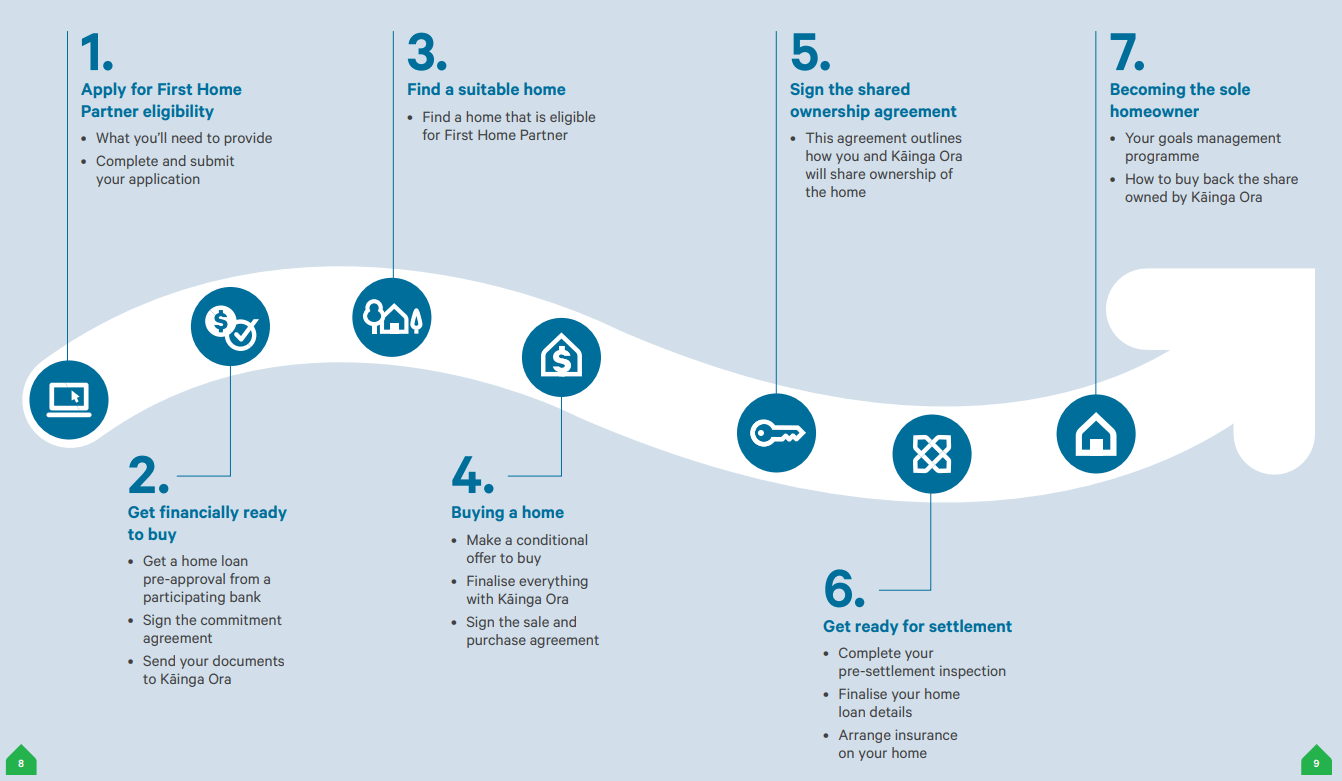

The Process...

If this has sparked your interest in the First Home Partner Scheme, please feel free to get in touch today and we can get started on your application or prepare your next steps.

Looking forward to hearing from you,

Fiona

NZ Mortgage Advice are a team of experienced Mortgage Advisors based in Hawkes Bay & Nelson, helping clients across New Zealand with their lending.

Disclosure Guide

Privacy Policy

Phone: 020 4049 0099

Email: fiona@nzmortgageadvice.co.nz

Phone: 027 913 3931

Email: amy@nzmortgageadvice.co.nz

Address: PO Box 93016, Bayview, Napier, 4149